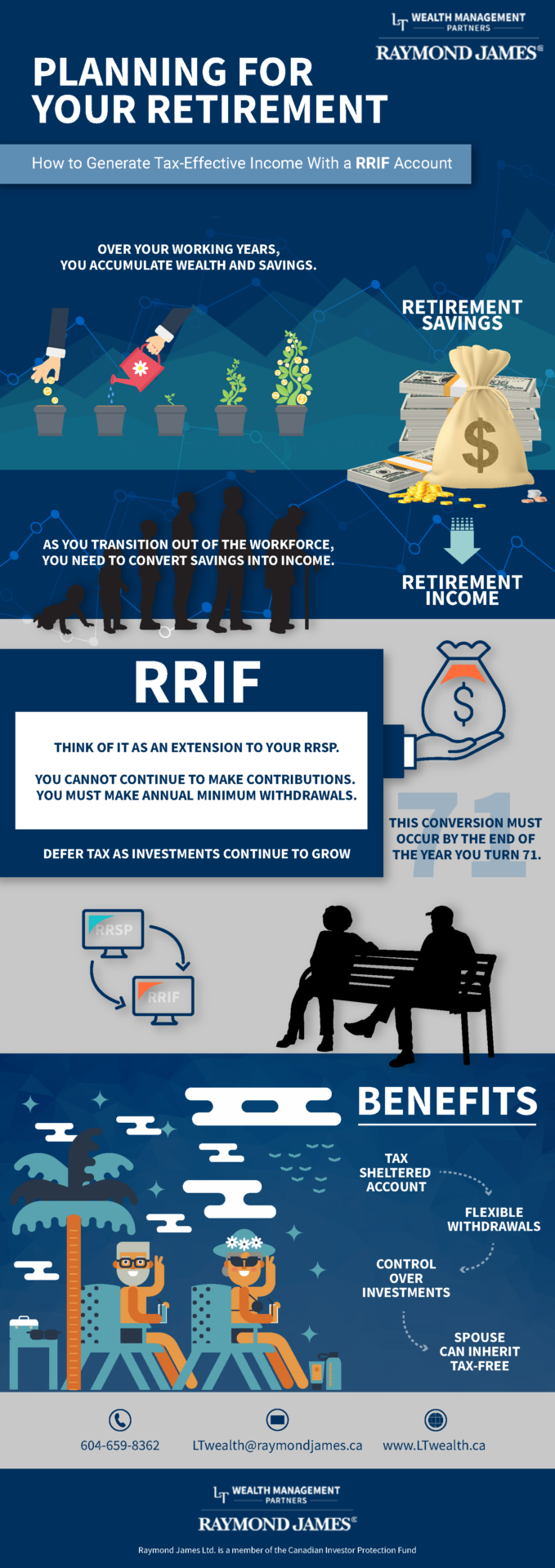

So you’ve been diligently saving and contributing to an RRSP. Great! But do you know what you’ll do with your RRSP at retirement? As you leave the workforce and retire, you’ll need to convert those retirement savings into retirement income with a RRIF Account.

What is a RRIF Account?

In short, a RRIF account is a tax-deferred retirement plan designed to provide you with steady income through retirement from your accumulated savings in your RRSP.

Think of a RRIF as an extension of an RRSP – An RRSP is used to save money for retirement and a RRIF is used to provide income during retirement. There are several similarities between the two plans. Just like with an RRSP, you can defer paying tax on your investments in a RRIF while they grow. Also just like an RRSP, a RRIF can hold a variety of investments.

There are two major differences between a RRSP and a RRIF:

- You cannot continue to make contributions to a RRIF

- You must make annual minimum withdrawals from a RRIF

How do I receive income from a RRIF?

You must convert your RRSP to a RRIF by the end of the year you turn 71. It is important to keep in mind that once you do, you are obligated to take a minimum amount out of your RRIF each year. The amount you withdraw is determined by your age, and this amount is taxable.

What are the advantages of an RRIF account in retirement?

Flexible withdrawals – there is a minimum withdrawal that you must take each year. However, how much income above that minimum you take and how frequent the payments are is up to you. You also have the option to make changes should your circumstances change. You can also choose to use your younger spouse’s age to lower your minimum withdrawal.

Tax sheltered account – you do not pay tax on the money in your RRIF, until it is withdrawn. This includes any money you make from your RRIF investments.

Control over your investments – you can choose from a variety of investments in your RRIF, such as mutual funds, GICs, stocks and bonds, allowing your money to grow tax free.

Spouse can inherit tax free – if you name your spouse as the beneficiary to your RRIF, the plan can be transferred to their RRIF (or their RRSP if they are under 71) without any tax consequences.

Ultimately, the decisions you make about how to use your RRIF will be personal, and the plan you put in place should reflect the things unique to your situation and expected lifestyle. A RRIF is the part of your plan that starts once you retire and is only one piece to the complex retirement puzzle. The key is to start early and get the right advice so when the time comes to embrace retirement you can rest easy knowing you’re in the best possible position to enjoy some of the most memorable years of your life.