When it comes to investing, there are two widely recognized styles that differentiate money managers: value investing and growth investing. The two schools of thought have fundamental differences that bring advantages and disadvantages depending on the economic environment.

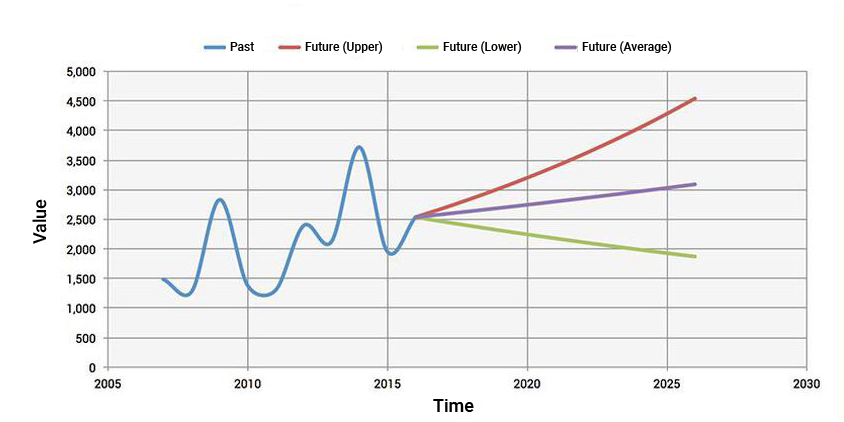

Over the past 7-10 years, growth has outperformed, but over the long-run value tends to have the edge. In the past 12 months, the DJ US TSM Value Index beat its Growth Index counterpart 3.8% to 2.1% – indicating a potential turning of the tide from growth to value.

Is your retirement portfolio overexposed to growth stocks? What will that mean for your investments? First, let’s take a look at the different investment styles…

Value Investing: Bargain Hunting for Investments

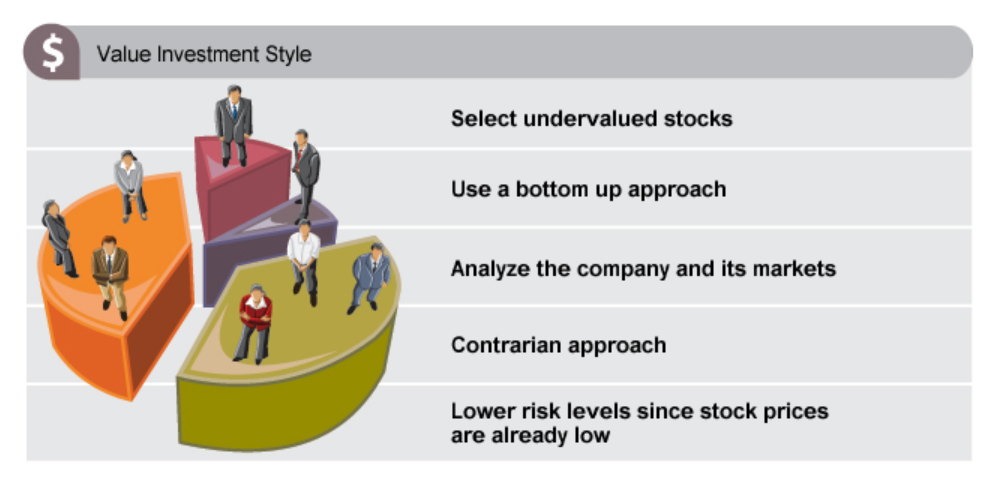

Value investors look for companies whose current stock price appears to be less than their intrinsic or fundamental value. They may be companies in the midst of a turnaround, suffering a cyclical downturn, or operate in a sector of the economy currently out of favour.

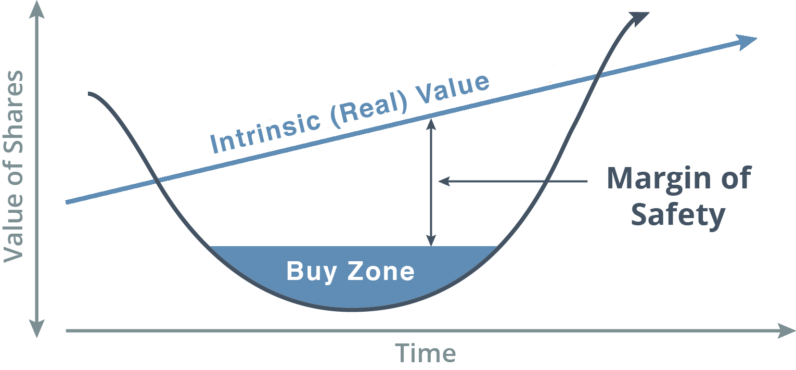

One way value investors identify potentially undervalued stocks is by measuring the price of the shares against the published earnings (P/E), cash flow (P/CF) or book value per share (P/BV). When these ratios are low, it is a preliminary signal that the shares may be trading at a bargain price. The bigger the bargain, the more room there is for error. This buffer zone is referred to as a margin of safety.

When the market environment turns around, and the security starts to be recognized by other investors, the price of the security will rise, and value investors will take a profit.

Growth Investing: Spotting Winners

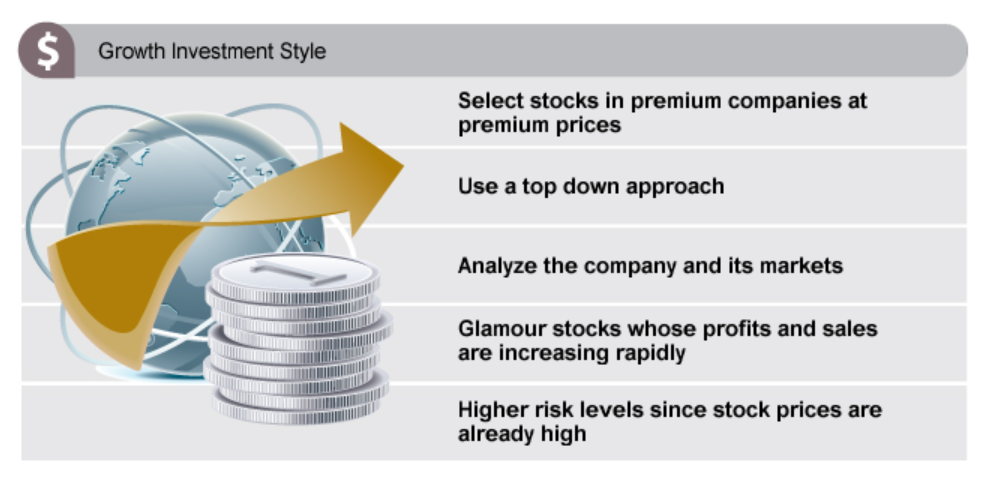

The growth investment style concentrates on opportunities that provide future earnings potential with less emphasis on current price. Value investors tend to see “growth” equities as being over-valued.

For a growth investor, higher trading multiples (P/E, P/CF, and P/BV) indicate that the market is placing a premium value on their investment growth potential. Growth investors target industry sectors that are enjoying above-average growth in the economy and look for the best companies in those sectors to invest in.

The challenge is that growth stocks can be subject to short-term market corrections if a majority of investors turn from buyers into sellers. Growth stocks by their nature depend on steady earnings growth and so can be vulnerable during economic downturns.

What Kind of Investor Are You?

Value investors are by their nature more comfortable with a buy-and-hold approach to investing. Research before investing and patience afterward are part of the style for successful value investing. As a result, value investors are careful stock pickers and their risk tolerance tends to be lower. They look for a strong dividend record and anticipate a steady but not spectacular capital appreciation of their investments.

Growth investors often look for momentum in a particular company or industry, or for broad economic indicators that will “raise all ships” in a given industry sector. Over-valued or under-valued share price is less important because investor enthusiasm will play a large role in determining share price, not the equity’s intrinsic value. A growth investor will be more likely to view media information and market trends as indicators of when to buy or sell. As a result, there’s a speculative element that means higher risk tolerance needed for growth investors.

Sector Rotation: The Best of Both Worlds

The two investment approaches are not mutually exclusive, and rarely do investors remain strictly confined to one investment style. The two styles tend to alternate in cycle, with growth outperforming for a few years and value outperforming in others. In recent years, growth has outperformed value largely driven by tremendous growth in companies like Facebook, Amazon, Uber etc. This is a common trend during bull markets fueled by loose monetary policy.

When you take a step back and look at performance over the long-term the story starts to change. There are numerous studies that suggest value, on average, has outperformed growth over the long run. (Report by Templeton Investments, report by Fidelity).

Ultimately, combining value and growth is a strategic option in a well-diversified portfolio built for the long term. We believe value companies with solid fundamentals will start to overtake growth companies given their recent under-performance.

Investment style is one of the key areas that you should be clear about with your advisor. Risk tolerance, and long-term objectives also need to be considered. You should consult a financial professional before making any changes to your investment strategy. Feel free to contact LT Wealth to discuss value and growth investment style’s in further detail.