In this month’s client’s corner, Nick Murray discusses three bear market crises we’ve seen in the last 50 years.

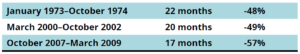

The three bear market episodes under discussion here are:

Keep these three downturns in your mind as we look at certain financial and economic measurements from the onset of the first of these crashes up to the present day.

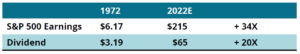

Yes, after half a century of serial crises, the value of the S&P 500 is up 34 times. Perhaps even more important is while inflation is up seven times in these 50 years, the cash dividend of the S&P 500 is up 20 times. Historically, equity dividends haven’t just kept pace with inflation, they’ve beaten the heck out of it.

Financial markets are resilient. They have crashed, recovered, and reached new highs time and time again. The best response a long-term, plan-driven investor can have during a crisis is no response at all—or, more accurately, to just tune out the doom and gloom of financial news and continue acting on your plan.

Talk to your financial advisor to ensure your investment strategy is structured to ride through volatile and uncertain investment periods. Especially during times of volatility, it’s best to consult a professional before making changes in terms of asset allocation, investment diversity, or risk tolerance.

There is no such thing as a risk-free investment portfolio in uncertain times, but there are ways to give you peace of mind and help you sleep well at night.

Wishing you all a joyous and peaceful holiday season. We hope you enjoyed this month’s Client’s Corner. Please do not hesitate to reach out if you have any questions or feedback.

Thinking about hiring a professional to help you implement a long-term financial strategy? We would be more than happy to set up a 30-minute discovery call to get a better understanding of your unique situation.