Something is happening in the financial markets that has never happened before. Investment yields on 30-year Treasury bonds are lower than the yield of the S&P 500. What does this mean? Essentially, the risk-reward payoff is overly skewed in favour of equities not only due to their ability to hold value against inflation, but also because of their ability to generate dividend income.

Equity vs. Fixed Income Oversimplified

Investing in common equities traditionally has two benefits:

1) Capital gains, which arise as the value of your stock holdings increase over time.

2) Dividends, which come in the form of periodic payments from the company to shareholders. Essentially profit sharing with shareholders.

Investing in fixed income on the other hand typically has the sole benefit of receiving a pre-specified amount in the form of an interest payment or coupon. Fixed income investors do not get the benefit of capital gains.

Low-Interest Rates Make Fixed Income a Tough Sell

In order to compensate fixed income investors properly when purchasing an investment that doesn’t offer the opportunity of capital gains, a higher yield or nominal rate is typically required. This however is not the case right now thanks to the low interest rate environment. The result is below average nominal returns on traditionally safe fixed income investments as well as zero chance of investment growth in the form of capital gains… Thats a pretty tough sell even before factoring in taxes and inflation.

As of Nov 3, 2020:

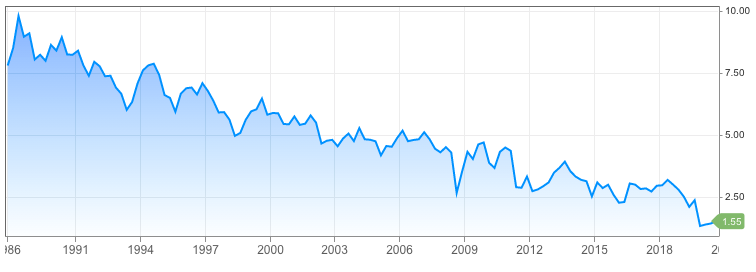

30-Year Treasury Yield = 1.55% (Source: CNBC)

S&P 500 Dividend Yield = 1.80% (Source: Ycharts)

Understanding Real Rate Of Return

The real rate of return is the annual percentage of profit earned on an investment, adjusted for inflation. Adjusting the nominal return to compensate for inflation allows investors to get an accurate picture of how their wealth or purchasing power changes over time. The formula for real rate of return is:

Real rate of return = nominal return – inflation rate

Similar to how taxes chip away at your earnings, so does inflation. The long-term inflation target in Canada, as well as the US, is around 2% per year. Say you were to purchase a 30-year US government Treasury bond today with a yield of 1.55%. Assuming the inflation target of 2% per year actually materializes, your real rate of return would be -0.45% per year. Contrast this with a hypothetical investment in an equity that grows by approximately 4% per year and generates a 1.8% annual dividend. Factoring in inflation, your total real return would be:

(Growth Rate) + (Dividend) – (Inflation) = (4%) + (1.8%) – (2%) = + 3.8%

+3.8% is a heck of a lot better than -0.45%, especially when compounded over the span of 30 years. Needless to say, it is absolutely critical to have a solid understanding of real returns prior to making any investment decisions.

Financial Advice is Crucial

Times are tough, and there is a lot of uncertainty in the markets right now. If you or someone you know are in need of financial advice, we are always happy to chat. We don’t charge for the first consultation, and there is no obligation to sign-up. Contact us to book a free financial consultation with one of our licensed financial advisors.

Alternatively, you can read more about investment yields and interest rates by filling out the form below.

Read The Full Commentary

If you do not have access to our monthly email, you can request it here:

Your privacy is fully protected. By filling out this form to request this month’s commentary, you give explicit permission for LT Wealth Management Partners to email you to deliver our e-newsletter. It is important to note that your consent acknowledges agreeing to receive our newsletter knowing that your name and email may be stored on external servers outside of Canada.