A question we get all the time from people looking for financial advice is, “What if I invest at the wrong time? I’ve saved my whole life, and I don’t want to see my retirement prospects go down the drain…”

This month, we’re going to look back to 1926 and determine when exactly would have been the worst time in history to invest your money into the stock market. We’re going to look at how that timing would have affected your retirement portfolio and how long would have taken to recover. We’re then going to finish with three things to remember next time the market takes an unexpected, yet inevitable dip.

When would have been the worst time to invest in history?

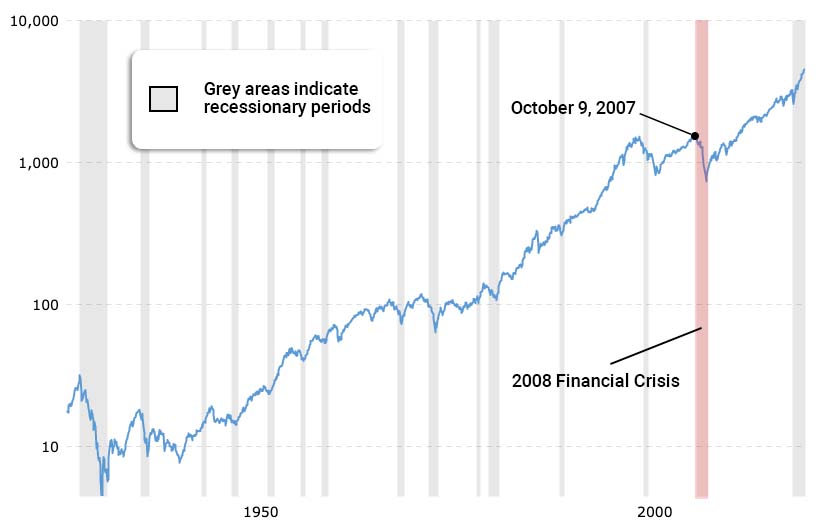

Since the days of the second world war, the single worst day to invest in the stock market would have been October 9, 2007. At this time, the S&P 500 was at its pre-financial crisis peak, where it closed at 1,565. over the subsequent year and a half, during the 2008 financial crisis, the market declined a whopping 57%. The S&P 500 index didn’t stop cratering until March 9, 2009 when it bottomed at 677 points.

S&P 500 Market Downturns 1926 – 2021

The absolute worst thing you could have done at this time was panic sell. The unfortunate truth is that many people did just that, inflicting permanent damage on their retirement portfolio.

How would this timing have affected my portfolio, and how long would it have taken to recover?

Once you sell, the damage becomes permanent. But, if, on the other you had an advisor by your side reassuring you of your long-term strategy, then it would have taken approximately six years to get back to the level at which you bought in. After 10 years of holding on, you would have achieved an average annual rate of return of just over 7%, and today, your average annual return would be sitting nicely at 10% per year. Pretty impressive numbers considering you invested at the worst time in the history of the stock market.

Three tips for the next time the market takes a tumble

There are three virtues you need to remember if you want to succeed over the long term when investing in the stock market: faith, patience, and discipline. Faith in the future is extremely important. This does not need to be any more complicated than reminding yourself in times of turmoil that “this too shall pass.” Patience is also extremely important. We’ve mentioned this many times on this blog, but time tends to heal all wounds for those who exercise patience. The final thing to remember is discipline. Discipline means having a plan and sticking with it during the good times and the bad.

So there you have it… Faith, patience, and discipline, the three critical qualities that will ultimately determine your success over a lifetime of investing. There will be times where you are tested and it’s important to lean on your plan when times get tough.

Thinking about hiring a professional to help you implement a long-term financial strategy? We would be more than happy to set up a 30-minute discovery call to get a better understanding of your unique situation.

Read The Full Commentary

If you do not have access to our monthly email, you can request it here:

Your privacy is fully protected. By filling out this form to request this month’s commentary, you give explicit permission for LT Wealth Management Partners to email you to deliver our e-newsletter. It is important to note that your consent acknowledges agreeing to receive our newsletter knowing that your name and email may be stored on external servers outside of Canada.