We often tell our clients when it comes to their investment portfolios that the road to retirement is a marathon, not a sprint. It is easy to get caught up in growth stocks and IPOs, but broad diversification with an emphasis on value investing and quality should always be the number one priority.

The Risk of mistiming the market

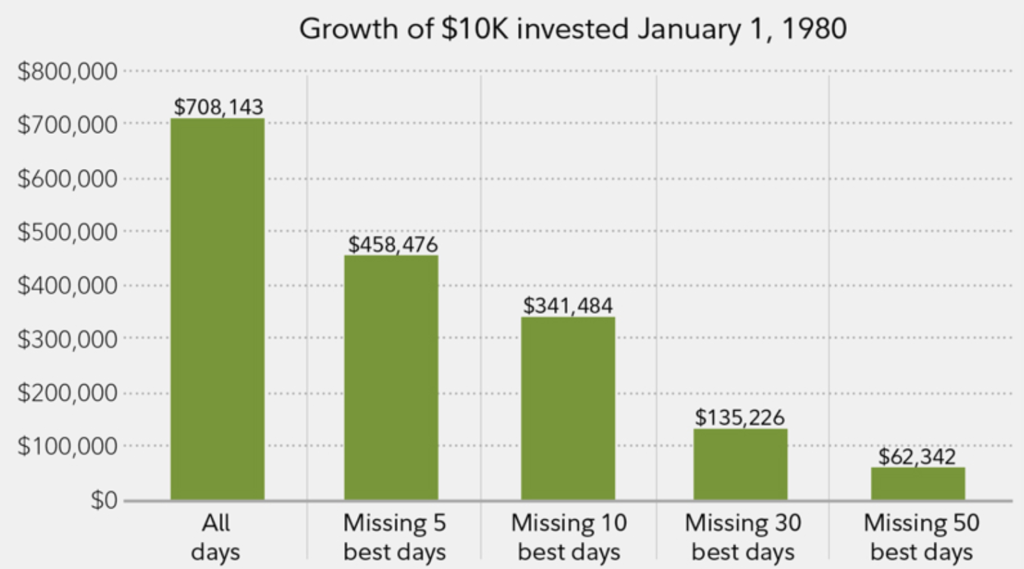

The stock market can be a wild ride. Swings of 30% during short but volatile periods are not uncommon. If things get really rocky, ups and downs of 15% in a single day are not uncommon. With that being said, what would happen if you tried to time the market and ended up missing out on the days with the biggest positive changes? Here’s what Fidelity found when they crunched the numbers on what would happen to a hypothetical $10,000 investment into an S&P 500 index fund from 1980 to 2018 and missed out on some of the best-performing days.

It isn’t pretty… Missing the five best days when you’re otherwise fully invested drops your overall return by 35%! Thats five days over the span of nearly 40 years! Missing out on the best 10 days will more than halve your long-term returns and missing out on the 50 best-performing days puts your portfolio in a sad state of affairs.

Gambling vs. Value Investing

The rise of direct investing platforms has blurred the lines between gambling and investing. Many people, especially in the younger generation, have one folder on their phone to house their stock trading app alongside their sports betting and poker apps. There is a difference between investing and gambling, and just because you have positive ROI on one or two or three bets, doesn’t make you a successful investor – it makes you a lucky gambler. Investopedia does a great deep dive on some of the key similarities and differences between investing and gambling if you want to read more.

Slow and Steady Almost Always Wins

Time generally heals all wounds if you stick with your long-term plan. Earning a steady return year over year will not only be easier to handle emotionally, but it will also result in the predictable achievement of your retirement goals. Prioritizing both capital growth and wealth protection as part of an overarching plan is absolutely essential for investors looking to succeed over the long-term.

If you or someone you know are in need of financial advice, we are always happy to chat. We don’t charge for the first consultation, and there is no obligation to sign-up. Contact us to book a free financial consultation with one of our licensed financial advisors.

Alternatively, you can read more about the benefits of taking things slow and steady by filling out the form below.

Read The Full Commentary

If you do not have access to our monthly email, you can request it here:

Your privacy is fully protected. By filling out this form to request this month’s commentary, you give explicit permission for LT Wealth Management Partners to email you to deliver our e-newsletter. It is important to note that your consent acknowledges agreeing to receive our newsletter knowing that your name and email may be stored on external servers outside of Canada.