When it comes to investing, there are three definitive mistakes that can make or break your retirement. Nearly everyone who participates in the stock market will, at some point in their investment career, succumb to at least one of these psychological traps.

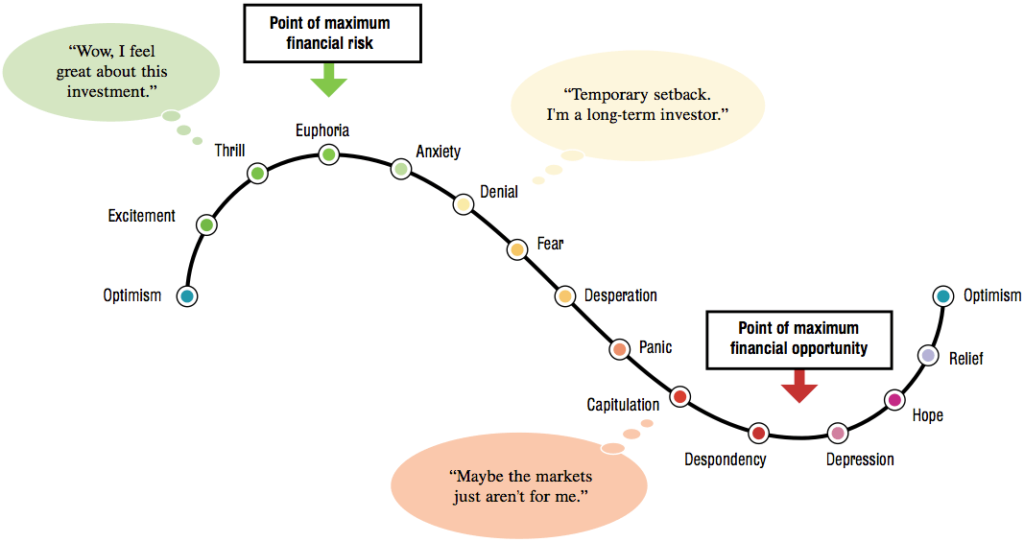

Before we get into the specifics, it can be useful to note the Cycle of Investor Emotions. The chart below was pulled from Modern Times Investors and highlights the ups and downs you will face as an investor living through both bull and bear markets.

The Cycle of Investor Emotions

The cycle moves in parallel with the stock market. When the market is pushing all-time highs, investors experience thrill and euphoria. When the market crashes and there’s blood in the streets, investors are likely to experience despondency and depression. Understanding the emotions that come with stock market highs and lows, is the first step towards making high conviction investment decisions. With that being said, let’s dive into three mistakes you must avoid if you want to make money in the stock market.

Mistake #1: Panicking During Market Selloffs

Market downturns are where fortunes are won and lost. The unfortunate truth is that selling when your account is down is one of the worst things you can do as an investor. It is also one of the best things for large-scale hedge funds and institutional investors because when you are selling, they will be the ones buying. You will view it as cutting your losses, and they will view it as a black Friday sale.

Warren Buffett once famously said, “The stock market is a device for transferring money from the impatient to the patient.” You always want to find yourself in the group of patient investors. It is easier said than done, but it is absolutely necessary if you want to make money in the long-term in the stock market.

Mistake #2: Mixing Politics with Investment Decisions

Many investors feel that they can anticipate market movement based on political factors. We have talked about this extensively in the past so if you want to dive more into the topic feel free to check out our past commentary on Election Hysteria. At the end of the day political events should not be considered an important factor when making investment decisions. Sticking with the theme of quoting the Oracle of Omaha, Warren Buffett once famously said “If you mix politics with investment decisions, you’re making a big mistake.”

Mistake #3: Performance Chasing

The third and final mistake involves market hype and the fear of missing out (FOMO). At the peak of a market cycle, stocks seem like they can only go in one direction—up! It’s hard to stand on the sidelines while you see your friends making money. It’s completely normal to want to get in on the action. As an informed investor, the key is to remember that while stocks go up over the long-term, they do not go up in a straight line. You still want to buy in at a decent price.

So there you have it. If you can avoid these three mistakes, and keep your emotions in-check, you will be well on your way to finding long-term success in the stock market.

Want to implement your own long-term Financial Strategy?

If you or someone you know are in need of financial advice, we are always happy to chat. We don’t charge for the first consultation, and there is no obligation to sign-up. Contact us to book a free financial consultation with one of our licensed financial advisors.

Read The Full Commentary

If you do not have access to our monthly email, you can request it here:

Your privacy is fully protected. By filling out this form to request this month’s commentary, you give explicit permission for LT Wealth Management Partners to email you to deliver our e-newsletter. It is important to note that your consent acknowledges agreeing to receive our newsletter knowing that your name and email may be stored on external servers outside of Canada.