Clients often ask: how much cash should I have in my portfolio? Many people consider it a safe choice, particularly when prices are high. In this post, we are going to dive into the role of holding cash in your portfolio and answer the question of how much cash is optimal for long-term returns.

Why Should You Hold Cash?

Cash is an important element of any investment portfolio because it will allow you to capitalize on cheaper prices during market pullbacks. Often referred to as “dry powder”, having a healthy amount of cash loaded and ready can prop up your returns nicely over time as you accumulate stocks at attractive prices.

There is also value in holding cash for its ability to cover unplanned expenses. Cash is flexible, liquid, and can bring peace of mind during uncertain times. If you lose your job or decide to start a business, for example, it might be beneficial to hold slightly higher levels of cash.

What are the Risks of Holding too Much Cash?

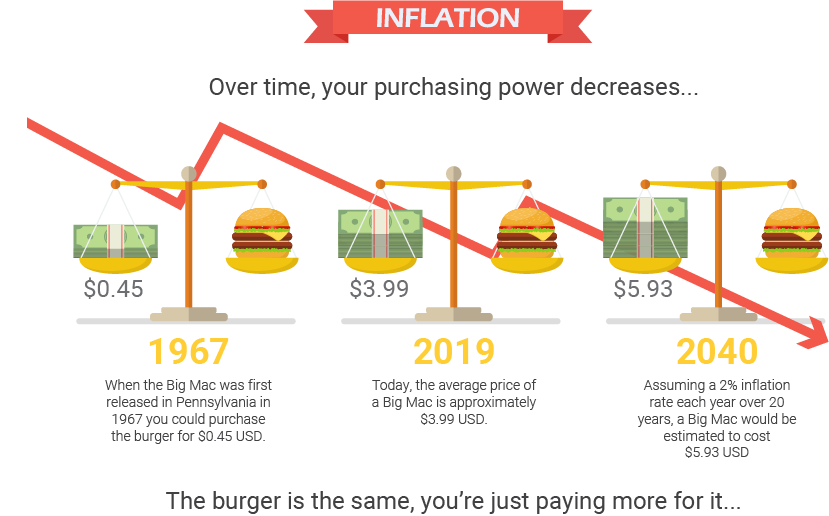

The main risk of holding cash is that you are guaranteed to earn a negative return over time. The cause of this negative return is inflation, which has become a hot topic of late. Inflation, on average, reduces the value of your cash dollars by approximately 2% every year. So, if you aren’t putting your money into an investment earning at least 2%, then you’re losing money. Over time, this negative return can have a significant impact on your total wealth.

The infographic below is a fun little illustration showing the impact of inflation on the cost of a hamburger.

There has been a lot of talk around inflation rising in the near future due to the large amounts of government spending in response to the Covid-19 pandemic (CBC Article). The stats have yet to be realized, but projections show that inflation could be on the rise. If this does happen, the negatives of holding cash could be amplified.

Read more about current Canadian inflation data on Trading Economics.

How Much Cash Should I Hold?

As a general rule of thumb, if you are in retirement and withdrawing from your investment portfolio on a regular basis, you will want to hold a maximum of two years of withdrawals in cash and cash equivalents. If you spend $50,000 per year, you should be safe holding $50,000 to $100,000 in cash and short-term money-market funds.

Some advisors suggest holding a percentage of your portfolio — say 10% — in cash, but this approach can be flawed. If you have a large portfolio, you likely will be holding more cash than necessary and overexpose yourself to the long-term wealth erosion caused by inflation.

If, on the other hand, you are still earning income and have less of a need to pull money from your investments, you should hold enough cash in your checking account to cover 4-6 months of expenses. Everything else should be allocated to medium- and long-term investments that will beat inflation over time.

If you’re looking for somewhere to put your cash that will protect you against inflation and position you for long-term growth, feel free to reach out and book a discovery call with one of our experienced advisors.

Read The Full Commentary

If you do not have access to our monthly email, you can request it here:

Your privacy is fully protected. By filling out this form to request this month’s commentary, you give explicit permission for LT Wealth Management Partners to email you to deliver our e-newsletter. It is important to note that your consent acknowledges agreeing to receive our newsletter knowing that your name and email may be stored on external servers outside of Canada.