What is “Income Investing”?

Income investing is a type of investment strategy that focuses on generating a steady stream of income from investments, typically in the form of dividends, interest payments, or rental income. The goal of income investing is to generate a reliable source of cash flow to supplement or replace traditional sources of income such as salary or wages.

Dividend stocks are a staple in every income investor’s portfolio and should not be dismissed as a retiree’s investment only. Dividend stocks have a role to play in any portfolio, no matter the investor’s age or financial circumstance.

This month’s clients corner focuses on the holy grail of income investing – dividends. We’re going to be focusing on the following four questions:

- What exactly is a dividend?

- How do dividends help people compound their wealth?

- How do dividends help people in retirement supplement their income?

- How have dividend stocks held up during stock market downturns?

What Exactly is a Dividend?

Broadly speaking, companies have two options on how to spend their hard-earned profits:

1) reinvest profits back into the company, and:

2) distribute profits to shareholders.

Growing companies in their early stages will typically focus on reinvesting in continued growth. While well-established companies with market leadership will typically choose to distribute their excess capital to reward their shareholders in the form of a dividend. When discussing dividend investing, we are focusing on these tier-1 established businesses.

In short, a dividend is a portion of a company’s profits that are paid out as a cash distribution to its investors.

How do dividends help people compound their wealth?

For starters, dividends are taxed at a lower rate than interest income. In Canada, if you hold a dividend stock outside of your registered TFSA or RRSP, you will be eligible for the dividend tax credit, which will lower your effective tax rate.

Taxes aside, the main benefit dividends can have on compounding your wealth is due to reinvestment. As you receive your dividends, you have the option to reinvest that money into purchasing more stock in the company. Those stocks, in turn, will also earn dividend income, creating a snowball effect as your account grows over time.

How do dividends help people in retirement supplement their income?

As you enter retirement, income investing becomes more important. You will start to rely on dividends as a passive source of income to fund your lifestyle. Theoretically, if you have a large enough nest egg, you could live off of your dividends without seeing any depletion of your account value. More likely, the dividend income will reduce the need for selling stock positions to fund your life. The higher your dividends, the more flexibility you will have and the longer you will be able to live off your investments in retirement.

How have dividend stocks held up during stock market downturns?

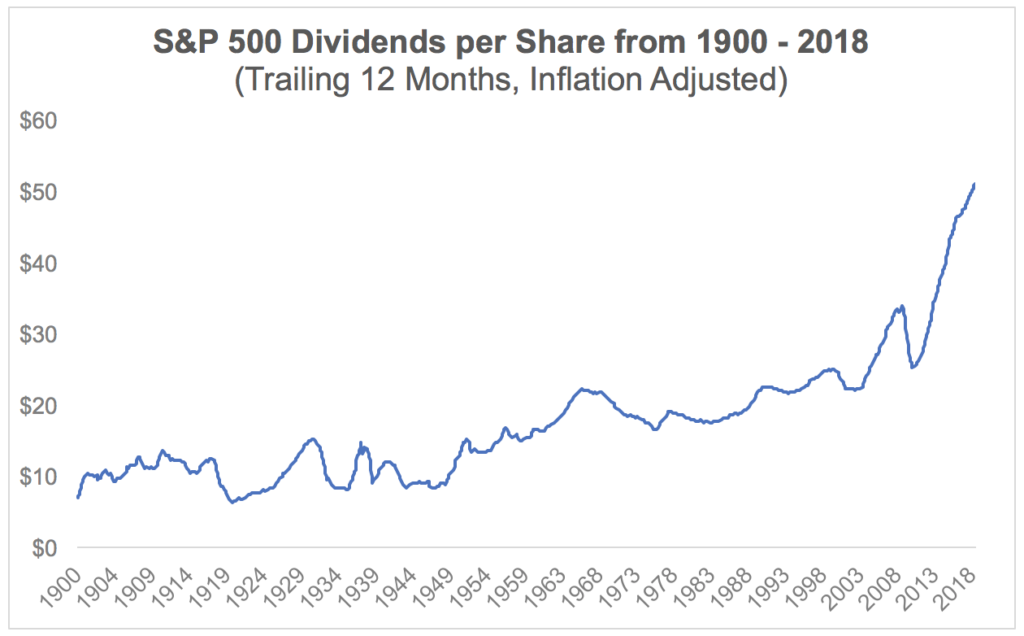

The chart below shows the average S&P 500 dividend per share from 1900 to 2018:

You can see that over-time dividends trend upwards at a relatively steady pace. In fact, during notable market contractions in 1974 and the early 2000’s dotcom bubble, dividends didn’t decline at all. There is a notable dip during 2008 during the financial crisis, but overall dividends contracted much less (approximately 23%) compared to the 57% correction felt in the broader market.

Fast forward a bit to the 2020 covid-19 pandemic, the market went down briefly by around 34% while dividends only went down a mere 3.6%. As of this moment in June 2021, dividends are ticking up strongly. Overall, dividends have a unique ability to withstand market downturns, making them an extremely reliable source of income.

If you’re looking for advice on investing in high-yield dividend-paying stocks, feel free to reach out and book a discovery call with one of our experienced advisors. We would be more than happy to go over some income-generating strategies that will help you achieve your long-term financial goals.

How do Dividends Affect Stock Prices?

Dividends can affect stock prices in several ways. When a company announces a dividend, it can attract income-focused investors and increase demand for the stock, potentially driving up the price. Expectations of future dividends can also influence stock prices, with anticipated increases generating positive sentiment.

On the other hand, reducing or eliminating dividends can lead to negative sentiment and a potential decrease in stock price. When a dividend is paid, the stock price is typically adjusted downwards to account for the cash outflow. Dividends can also signal a company’s financial health, impacting investor perception and stock prices.

However, some investors may prioritize capital appreciation over dividends, which can lower the stock price if a company pays out a significant portion of its earnings. Overall, the relationship between dividends and stock prices is influenced by market conditions, investor sentiment, company performance, and the broader economic climate.

Read The Full Commentary

If you do not have access to our monthly email, you can request it below.

Your privacy is fully protected. By filling out this form to request this month’s commentary, you give explicit permission for LT Wealth Management Partners to email you to deliver our e-newsletter. It is important to note that your consent acknowledges agreeing to receive our newsletter knowing that your name and email may be stored on external servers outside of Canada.