What does the phrase financial planning mean to you?

Financial planning is an umbrella term that covers many subjects, such as:

- Determining lifestyle expenses

- Planning for your children’s education

- Building wealth through tax-efficient investment portfolios

- Minimizing your tax burden

- Ensuring a comfortable retirement

- Mitigating risk through insurance

- Leaving a legacy for your heirs

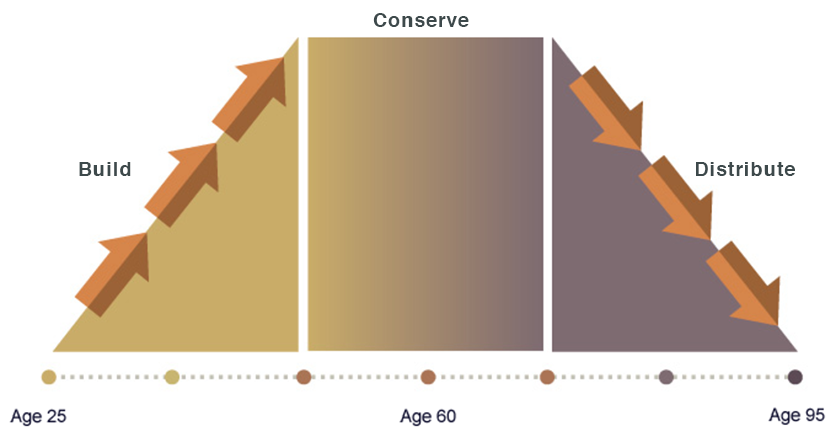

Effective financial planning should include all of the above. Think of it as a continuous life-long process, prioritizing and guiding your personal decision-making and imposing order on your financial life. A financial plan for you and your family creates a comprehensive and integrated road map as you travel through life’s financial stages.

Life’s financial Stages

Wealth-building stage

A financial plan helps you make the most with the least in your early years. It’s about setting aside funds for a first home, planning for the children’s education and safeguarding your future with the proper insurance protection. It’s a time to start an investment and savings plan that ensures some of your financial resources are invested properly and growing

Wealth growth and preservation stage

Through the peak earning years and in anticipation of retirement, your financial planning begins to reflect investment allocation and diversification strategies to protect and grow assets that can provide retirement income. In this stage, it is important to protect and grow assets that can provide retirement income and sustainable growth.

Wealth preservation and distribution stage

Your retirement needs are now your focus. This includes estate planning and effective tax minimization strategies to ensure the orderly transfer of assets to your heirs and other beneficiaries without unnecessary tax burdens.

Key Financial Planning Components

As your financial plan evolves through life’s stages, it focuses on these key components:

Setting financial objectives: A financial plan starts by knowing where you are now – an inventory of current financial assets and liabilities – and where you want to be in the future. How much do you need to set aside for the major purchases and events in your family’s life, including your dreams for retirement? How do you finance this vision of the future? A financial plan helps you find the answer.

Lifestyle management: This is much more than balancing a checkbook every month. It’s a cash management program to deal with debt reduction as well as prioritizing and managing your income and expenses.

Tax planning: Effective tax-planning involves knowing how to save, invest and spend with the least tax burden. It begins for many with individual RRSPs, RESPs, and TFSAs. More advanced strategies come into play when you start to consider a corporate account. Down the road, more complex tax strategies come into play as estate-planning objectives dominate your financial plan.

Risk management and insurance protection: In life’s early stage, insurance helps to mitigate risk and safeguard you and your family against sudden personal losses. It also can protect your income in the event of a disability or catastrophic critical illness. In retirement, insurance may play an important role in providing you with an annual tax-free income. It may also help cover long term care expenses, as well as protecting the value of your estate for heirs and beneficiaries.

Investment planning: As each of your financial stages evolves, financial needs, risk tolerance and investment strategies will change. These changes are internal, but there are also external factors to consider. Inevitable changes in the market, government tax laws and economic conditions will also affect your investment strategies. As time progresses, your asset allocation will change as these internal and external changes are accounted for in your investment plan.

Retirement planning: Preparing for retirement begins with a sound financial plan. The goal is to give you control over when you retire. With a solid financial plan, you become organized with regards to building and protecting financial resources.

Estate planning: The capstone of any financial plan involves successful estate planning and asset distribution. This is the legacy you leave behind for your loved ones. With a proper estate plan, you can ensure you leave your beneficiaries with a minimum tax burden.

If not now, when?

A financial plan is about you, your family and the kind of future you want to create. Everyone, no matter what age or stage in life will benefit from the planning process. If you are looking to develop or enhance your own financial plan, feel free to reach out for a confidential consultation. Our team of experts at LT Wealth are here to help proactive individuals achieve financial freedom.

We offer several free financial planning calculators, such as our mortgage calculator and the cost of not investing calculator. View all of them here.