We do not live in a static world. It is dynamic and frequently changes. As things change, sometimes we need to be flexible and adapt our tactics. After all, there are companies that were great 30 years ago that just aren’t as cutting-edge as they used to be. On the flip side, there are also fundamental principles that have stood the test of time that act as anchors for your long term investing.

One of the greatest advantages you can have as an investor is a long-term perspective. Effective financial planning absolutely needs to take into account your short and mid-term goals, but the magic really happens when you take a step back and think big. Here are 5 key things to keep in mind when structuring your long-term plan:

1. Plan on living a long time.

Thanks to advancements in technology, people are living longer and healthier lives. According to Statista Research, the average life expectancy for Canadians is 80 for males and 84 for females. If you plan to retire at age 65, you need to be prepared financially for 15+ years of living off your investments. You simply can’t plan properly for a 15+ year retirement unless you spend time talking with your advisor about your long-term goals.

CPP deferral is one strategy that can be used to help plan for a longer retirement, but there is no substitute for starting the planning process early and thinking long-term.

2. Harness the power of Dividends and Compounding.

Albert Einstein famously said “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” Einsteins’ belief has stood the test of time, and years later, the core principle of making your money work for you is equally as relevant today as it was back then. When it comes to compounding, one of the most important factors is time. Check out our Cost of Waiting calculator to see the impact 10 years can have on your investment portfolio.

3. Stick to a plan, stay invested, try to avoid emotional bias.

Having a plan and sticking with that plan is absolutely essential. It can be easy to get sucked in by scary media headlines and hot stocks that are “going to the moon”, but the reality is that most of this is just noise. It is extremely important as an investor to remain cool, calm and collected and make your investment decisions based on your long-term goals and objectives. Rash decisions based on emotions can be devastating to your overarching retirement goals. Check out our Stay Invested Calculator to see how missing out on the best performing months in the stock market can affect the growth of your portfolio.

4. Volatility is normal, don’t let it derail you.

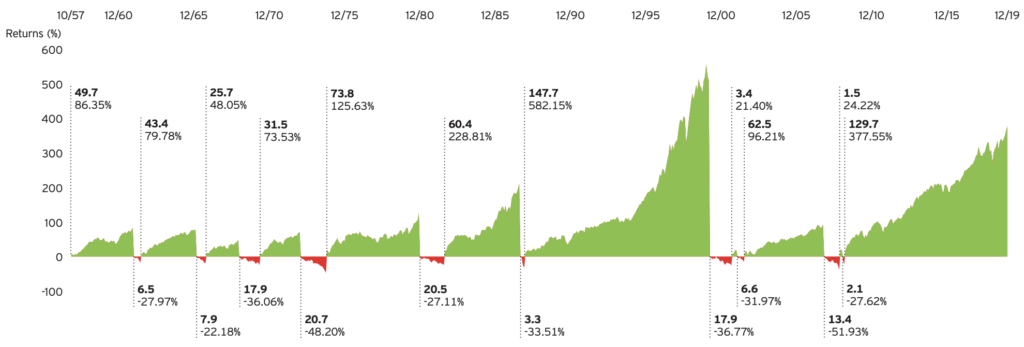

Market fluctuations are a normal part of investing. If you expect stocks to go up in a straight line, then you are kidding yourself. The key is to remember that over time, the uptrends tend to outweigh the downtrends. Thinking long-term can keep things in perspective and prevent you from panicking during the brief downtrends.

The chart below from Invesco traces the history of bull and bear markets and the performance of the S&P 500 during those periods. In general, the downturns tend to be shorter and less impactful than the long-term upward trend.

5. Diversification works.

Diversification is an investment technique that reduces risk by allocating investments across various financial instruments, industries and other categories. Not all types of investment perform well at the same time. Different types of investments are affected differently by world events and changes in economic factors such as interest rates, exchange rates, and inflation. Diversification allows you to spread the risk in your portfolio across a range of investments, which will ultimately improve the risk-reward profile of your portfolio putting you well on your way to achieving your long-term financial goals.

Want to implement your own long-term Financial Strategy?

If you or someone you know are in need of financial advice, we are always happy to chat. We don’t charge for the first consultation, and there is no obligation to sign-up. Contact us to book a free financial consultation with one of our licensed financial advisors.

Read The Full Commentary

If you do not have access to our monthly email, you can request it here:

Your privacy is fully protected. By filling out this form to request this month’s commentary, you give explicit permission for LT Wealth Management Partners to email you to deliver our e-newsletter. It is important to note that your consent acknowledges agreeing to receive our newsletter knowing that your name and email may be stored on external servers outside of Canada.